Menu

Before we get to the gist of this article, let me first ask you a few important questions: What’s holding you back from investing your money? Why not keep your money in the bank?

You wouldn’t want a sleazy hedge fund manager making very risky and non-transparent decisions with the cash you have worked so hard to save. And perhaps you don’t want to put up with the uncontrollable highs and lows of the stock market. You want to play it safe, so you think it would be better if you just leave your savings alone.

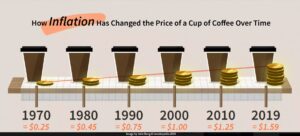

In that case, inflation will take a toll on the “spending power” your dollars have, rendering your cash less valuable the longer it stays on the sidelines. But at least its there, safe and sound… right? Let’s face it: You wouldn’t want your money to sit inside a bank vault, doing nothing – not being employed to attract more dollars to you. Such a waste of time and opportunity! You should want it to grow so you could invest it in more profitable ventures. Only then should you feel comfortable going to town with the income it brings.

In the fabulous book “The Richest Man in Babylon,” Arkad, a young man who learns the secrets of growing wealthy from a money lender in his later years, happy to give advice. In the book, he is told that the secrets to investing is to live on more than you earn, learn from people and books on where to invest your funds, and – more relevant to us here – reinvest your profits, and your profit’s profits, and so on. Keeping a huge savings locked up in a bank or a poor investment or low rate of return vehicle goes against this timeless advice.

You should be aiming for the best type of income, passive income. This is income that flows to you while you sleep. Real estate fits this bill perfectly!

Before we explain why Real Estate Investing (REI) is for everyone – and I, mean EVERYONE – let me share a few insights.

At this point, you are probably thinking, “Well, Derek, you’re a real estate investor yourself, so it’s obvious what you’re in favor of!” Well, I am totally aware of my own bias towards my own niche (which, for the record, helped us build a multi-million dollar portfolio of value-add property). Regardless, allow me to indulge you with some of the juiciest facts about REI that you should know about:

What do these numbers mean? Well, apart from the fact that millennial investors are focusing on building their REI portfolios and many more are jumping out of the 2020 stock market train in the midst of this global health crisis, real estate has become a rational option for investors who would rather accumulate wealth at lower risk. So I want you to forget about me for a moment and focus on why you should double down on making it as a real estate investor.

I know it’s all gobbledygook from think tanks and experts who think they already know a lot about real estate, but the fact that several secondary real estate markets are performing well (even during a pandemic!) should be enough reason to look to invest your hard-earned money on rental properties that guarantee substantial year-on-year returns. We want to deploy our capital in areas that are growing and there are ALWAYS markets that are doing so in any point in the economic cycle.

Here’s the deal: ANYONE can jump in on the action. Plus, there are countless reasons why investing in real estate makes sense if you are looking to generate wealth, whether aggressively or in a more passive manner. Having said that, let’s take a look at why you wouldn’t want to pass this up. Sure enough, if the following points wouldn’t cure your reluctance to consider REI, then I honestly don’t know what will!

If you don’t like the thought of buying stock, mutual funds, and other securities, then REI is be the best option since it lets you handle a portfolio of tangible assets that can be improved as you go along. Sure, you get substantial returns from bonds and stocks, but there is very little control you have over increasing the value of the asset unless you sit on the board of that company. On the other hand, with REI, it’s possible to manipulate your assets in ways to directly increase the value of your investment.

But that’s not all. Real estate investments in high-growth metro areas appreciate exponentially over time, thereby keeping up with inflation, while the debt payments are being paid down by your renters with fixed debt at very low interest rates. That being said, real estate could be a safe haven for your hard-earned cash so long as you find stable high-opportunity markets, whether in your immediate community or out-of-state.

Think your savings aren’t enough to get started building an REI portfolio? You’re in luck because you can still acquire profitable properties even with minimal capital. In fact, you can acquire real estate with no money at all. I know it’s crazy, but I know some friends of mine who actually bought multifamily properties by pooling hard money from private money lenders (a fancy way of saying “people you know,” like friends, colleagues, etc.). Other ways include utilizing hard money (borrowing the entire purchase price and rehab amounts) or partnering up with someone else who is just as wise and intelligent as you to invest in property!

Apart from other people’s money, there is also a variety of financing options to consider so you can afford the down payment of a target property. You can tap your Solo 401(k), apply for federal financing from Freddie Mac and Fannie Mae, or create a real estate syndication with partners who would very much like a share in the equity.

Benjamin Franklin wrote about how death and taxes are the only things that are certain in this world. Indeed, regardless of the type of investment vehicle you are opting, you still owe some dollars to the American government. At the back of your mind, you are probably thinking about keeping your tax liabilities low. But of course, you wouldn’t want to evade and avoid your tax obligations. With REI, you are in the position of getting the most out of your assets due to the numerous tax breaks you get to enjoy.

The U.S. government has always been supportive of initiatives aiming to revitalize entire communities. For that reason, you get substantial incentives if you improve your assets. On top of that, you also get property tax deductions, defer paying a capital gains tax if you are planning to sell your property at some point in the future, and make deductions on upkeep and maintenance.

At this point, the only question I want to ask now is: “Where will your money be if it weren’t stored in a bank?”

While having liquidity is a great thing, up to a point it is enough. If you leave all your cash sitting in one place, doing nothing, you’re letting the federal government and The Fed erode the spending power of the funds you worked so hard to accumulate.

It’s a doozy, but I would like your thoughts about the possibility of investing in real estate. If you would like to know more about the nuts and bolts of creating a portfolio of CASH-FLOWING assets, please feel free to reach out to us anytime!